What is NEoWave?

An interview with NEoWave theory founder, Glenn Neely

We are often asked the question: "What is NEoWave?" We chatted with Glenn Neely to hear his unique story of how he created NEoWave after learning about Elliott Wave, teaching Elliott Wave principles, and seeking ways to continuously improve Wave Theory to make it more scientific, logical, reliable, and accurate. In fact, he notes that, "NEoWave is all about predicting markets more precisely." Here is Glenn Neely's answer to this often-asked question.

What is NEoWave? It's taking Elliott Wave in its original form and sequentially ordering every single step of the process to make it logical, objective, and understandable.

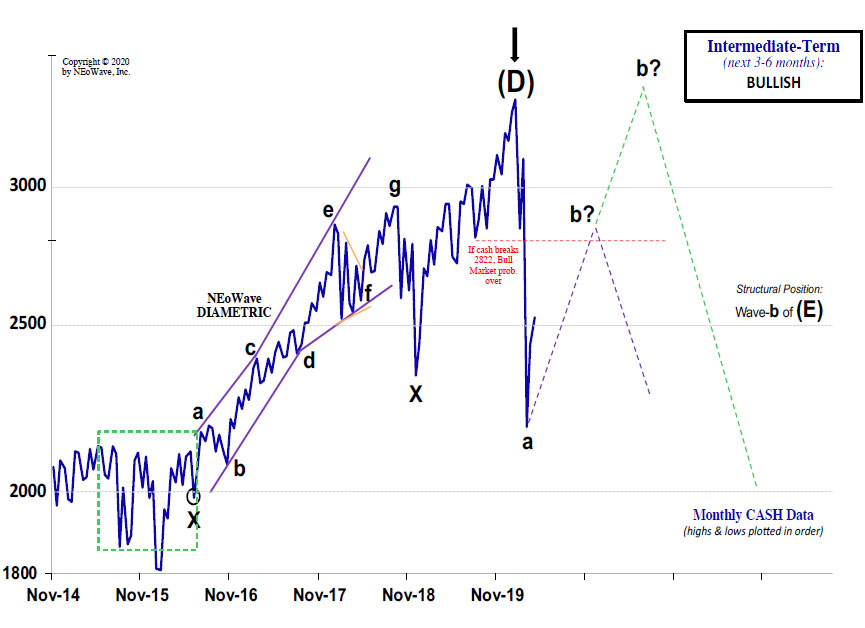

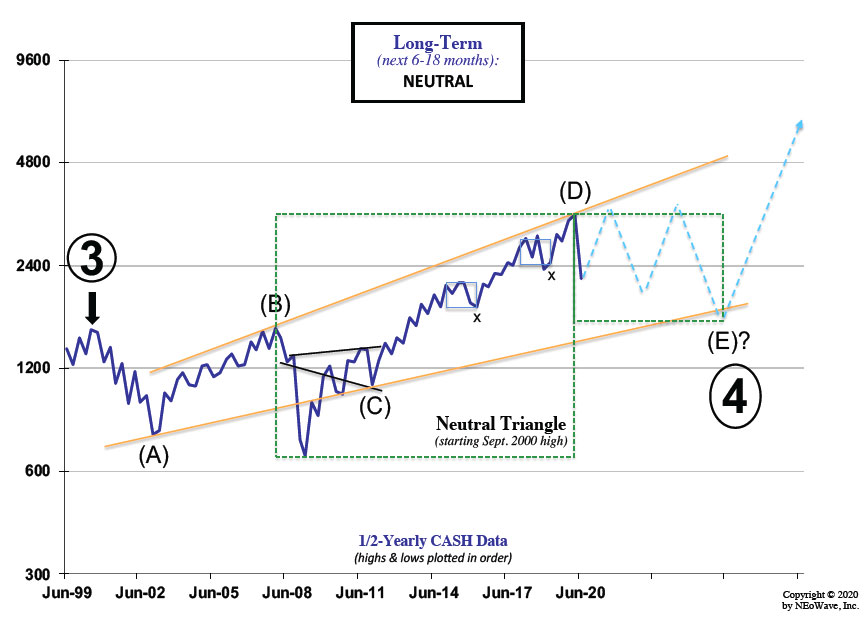

NEoWave involves controlling how the charts are drawn, and the kinds of data you use to draw the charts (which should always be cash data that doesn't expire). NEoWave explains how to plot the data, so you're not using bar charts in the normal fashion, you're using what's called Wave charts. This enables you to see the actual flow of market price action from high to low or low to high over time, which allows for more precise predictions.

Examples of two Wave charts...

Interviewer: Mr. Neely, how did you get started with Elliott Wave? And, over the years, how did you come to realize you needed to take steps to make it more logical?

I was working in the oil business and started reading books on stock market analysis. I came across a book containing descriptions of lots of different types of technical analysis, and Elliott Wave was one of those. When I read about Elliott Wave, I immediately thought, "This is it" because I had been searching and reading about markets for a year or two. Just reading the description about how it works and what it is, I immediately knew this was the concept or Theory – the explanation of markets – that I'd been looking for, because it was much more sophisticated and multidimensional than other concepts I had been reading about. It connected to human psychology and explained why markets undulated up and down and on larger and smaller scales. It made sense of all the randomness of market behavior.

So that's where it began. And then, I got every book I could find on the subject of Elliott Wave. Honestly, none of them were really great. After studying everything I could find on the subject, I started to realize there was just so much missing. No one told you how to plot your charts, how to start your charts, how to start the analysis, what kind of data to use in your charts. A lot of things were missing.

From this early knowledge I gained I decided, "Well, if I'm in this situation, a lot of other people are probably in this situation. Maybe I could start teaching people what I've learned about the process and how to do it better." So I started teaching.

I never realized that, from the teaching process, I would end up learning tons of new things about Elliott Wave that I never imagined – concepts that were not discussed in any of the books I had read. That's why I came up with so many different ideas about Elliott Wave over time. By teaching people and being asked questions and being forced to come up with answers and think deeply about answers and contemplating this over the course of many years.

Every time I came up with an idea, I realized something had been missing from the standard, orthodox Elliott Wave process. I would write my idea down on an index card, and I saved all those index cards. I had hundreds of them. Over time, the whole process of analysis started to become a sequential concept in my mind. I realized you do this first; you do this second; you do this third; you do this fourth. And I found that a logical process applies to each type of pattern.

I pieced my ideas together little by little over the course of years. I spent at least five years, maybe seven years, just studying, thinking, teaching, trading. Those index cards came in very handy when I realized I had created an entire objective process of analysis that had never been created before – and I could write a book on the subject: Mastering Elliott Wave.

The first thing I did was organize all those index cards! The philosophical concepts are Chapter 1, and then the plotting of data is Chapter 2. The steps to begin analysis of the data are in Chapter 3, and then scaling the data in Chapter 4. I go into regular Wave Theory concepts in Chapter 5, and then Chapter 6 talks about how you confirm patterns. And so on.

If you have Mastering Elliott Wave, you'll see that Chapter 8 goes into more complex, detailed information and detailed patterns. And the rest of the book presents more new ideas, new concepts, more sophisticated and detailed analysis.

(Read "What is NEoWave analysis?" for a brief chapter by chapter synopsis.)

Interviewer: Mr. Neely, you named your book Mastering Elliott Wave. At what point did you come up with NEo Wave?

When I wrote my book, I was laying the foundation for NEo Wave without knowing it. I showed preliminary copies to several people, and they all talked to me about calling it Neely Wave. However, I felt very uncomfortable about Neely Wave, because I didn't create the original Theory – I felt I was just adding to it. It's like calling math Neely Math just because you might take math to a new level, such as algebra or trigonometry. It's still math, it's just additional concepts and details to deal with more sophisticated and more complicated situations.

I felt that I expanded on Wave Theory – I did not create the original foundation of the Theory. Before I ever decided to call my process NEo Wave, I wrote a chapter in my book – Chapter 6 – on the topic of Post Constructive Rules of Logic. This is after you've gone through the whole process of collecting your data, putting your charts together, beginning the analysis, finding patterns, combining those patterns into impulsive or corrective formations, then you get to the actual confirmation process. After a pattern is over, you have to see certain kinds of behavior that prove your analysis was correct. Essentially, it's like making a prediction about the future, and the only way you know if you're right is to wait for the future event to happen, right?

So I have approached Wave Theory the same way. If you believe something is an impulsive pattern, or a five-Wave move, or zigzag or whatever it is, then after it's over, it needs to produce certain kinds of behavior to prove what you thought it was is actually what it was. That's what Chapter 6 is all about.

At the end of Chapter 6, because I didn't feel comfortable calling it Neely Wave, I just called Chapter 6 the Neely Extensions of Wave Theory, because this is where I really started to move into new areas and creating all kinds of new concepts to make the process of analysis more sophisticated, more logical, more objective, and more scientific. So I called it Neely Extensions of Elliott Wave Theory.

About 20 years after I wrote my book – and based on hearing what the public had to say – I decided to call my business and my Wave Theory process something else. I decided on NEoWave, which is a shortened version of Neely Extensions of Wave Theory. And that's the reason why the N and the E are capitalized.

(Read "NEoWave vs. Elliott Wave – How Do They Differ?" for why NEoWave is a more reliable Wave trend indicator.)

Interviewer: We are now celebrating the 30th anniversary of Mastering Elliott Wave. This classic book continues to be relevant. In fact, it's the go-to resource for anyone who wants to learn or master Elliott Wave. As a company, NEoWave has shifted and grown over the decades. Briefly, can you share a bit about how you developed your expertise in trading?

After maybe 15 years of getting progressively better at doing Wave analysis and forecasting, I started to notice that my ability to predict markets was progressing at a faster rate than my ability to trade markets. That was very perplexing to me. I assumed (which most people do) that to be able to trade and make money, you have to be able to predict the market. Everyone assumes one is directly related to the other.

As I got better and better at forecasting, I noticed that my ability to forecast was increasing at a much faster rate, say, logarithmically, whereas my trading and results from trading were probably only progressing arithmetically. My trading results just weren't keeping up with the accuracy of my forecasts. And that really started to bother me and perplex me. It caused me to question: "What am I missing? What's going on?"

Finally, after 15 to 20 years of being in the business, it started to dawn on me that trading and forecasting were not the same thing. This is the reason why I experienced good periods of trading, followed by bad periods of trading: When the market is in a situation that enables you to forecast, you can do well. When you can't forecast, you can't do well.

I started to realize that my ability to predict went in stages. For example, we can generally predict the trending phases of an impulsive or corrective pattern, which means you can generally predict Wave 1, Wave 3 and Wave 5 pretty well, but you can't predict Waves 2 and 4 that well. And you can predict Wave A and Wave C and a correction pretty well, but not Wave B.

That realization was the beginning nucleus, the foundation of what I now call Neely River Theory, because I began to look for ways of trading markets that aren't directly connected to forecasting markets. And that's how my initial research came about. It took about 20 years for me to piece that whole complex puzzle together!

Interviewer: Mr. Neely, you always say that forecasts don't make money, effective trading techniques make money.

That's right. When it comes to trading, your goal is to make money. You have to worry about that situation all the time. So it's a very different thing. NEoWave is all about predicting markets more precisely. And Neely River is about trading markets more profitably.