Education / NEoWave Explained / What is the difference between NEoWave and Elliott Wave?

NEoWave vs. Elliott Wave - How Do They Differ?

The three core elements of Elliott Wave are:

- the Fibonacci number series

- pattern recognition

- the Golden ratio (.618)

All three elements have a "forecasting" or "anticipatory" aspect, in which the analyst is expecting the market to move up or down a certain number of "waves", which adhere to a predictable design and have specific relationships. (Note, the concept of "waves" was not objectively defined in any literature until the release Mastering Elliott Wave in 1990)

The three core elements of NEoWave are:

- Logic (e.g., a strong correction must yield a powerful move),

- Self-defining price/time limits (e.g., a smaller degree pattern cannot take more time and price than a larger degree pattern), and

- Self-Confirmation (i.e., the market's post-pattern behavior determines whether your prior structural analysis was correct).

All three NEoWave elements have a "back-casting" or "reactionary" aspect, where the analyst is making sure (after the fact) a pattern did not take too much or too little time, that it was not too complex or too simple, and that post-pattern price action achieved the minimum movement required to confirm the prior pattern.

What is the difference between NEoWave and Elliott Wave? How is NEoWave better?

The Elliott Wave Principle, named for its discoverer, Ralph Nelson Elliott, quite simply measures how groups of people behave. One of the easiest places to see this phenomenon at work is in the financial markets, where changing investor psychology is reflected in the form of price movements. While it had been thought that traders behaved in a somewhat chaotic manner, R.N. Elliott discovered they actually traded in repetitive cycles, which, it turned out, were the emotions of investors as a result of outside influences.

The up-and-down swings of the mass psychology always showed up in repetitive patterns, which were then divided into patterns that R.N. Elliott named Waves. His Wave theory went on to reveal that if you can identify repeating patterns in prices – and figure out where those repeating patterns occur – then you can predict where the market is heading.

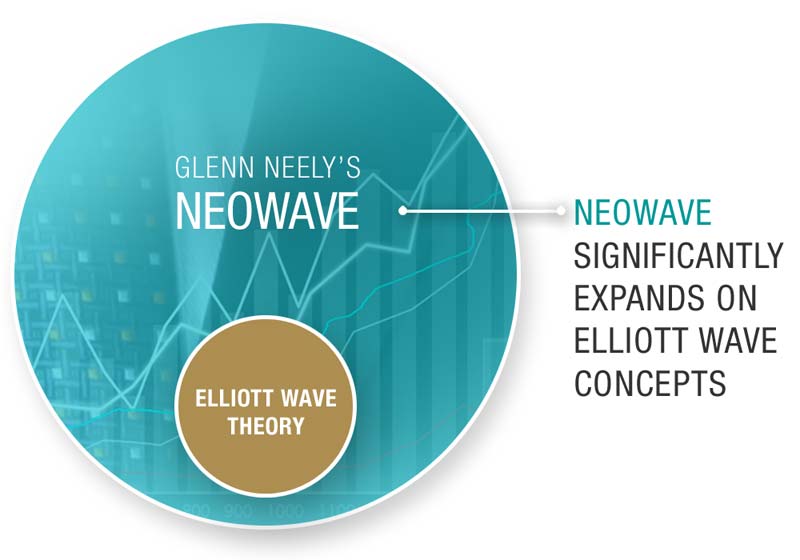

On the other hand, NEoWave goes beyond the teaching of Elliott Wave principles.

Glenn Neely's NEoWave analysis techniques offer a logical, scientific, and objective approach to Wave forecasting.

By following the three core elements of NEoWave (as mentioned above with Logic, Self-defining, and Self-confirming), NEoWave goes beyond the "forecasting" or "anticipatory" of Elliott Wave principle.

NEoWave sets additional rules and concepts to the wave analysis process that elevates it out of the realm of supposition and into the realm of science.

Therefore, with the addition of the above "new" rules to orthodox Elliott Wave, NEoWave is formed and makes it possible to produce wave counts that stand the test of time.

Why is NEoWave a more reliable Wave trend indicator?

In 1988, Glenn Neely was one of the only bullish analysts in the world. Among orthodox Elliott Wave practitioners who were extremely bearish (and remained that way for most of the last 30 years), Glenn stood alone and was heavily ridiculed for his extremely bullish, long-term forecast. It was the logic of NEoWave that allowed Glenn to remain so adamantly and confidently bullish on the U.S. stock market, despite massive public condemnation and even in the face of negative national and international news.

It was NEoWave that allowed Glenn Neely to turn adamantly bearish on the U.S. stock market near the highs of 2000 and then, two years later, turn bullish again just six months after the 2002 low. Finally, in January of 2008 - once again, despite strong opposition - he turned adamantly bearish on the U.S. stock market. It was NEoWave that gave Glenn Neely the courage to announce to the world in mid-January 2008 that a new bear market began and that there was virtually nothing that could be done to stop the downward spiral of the U.S. stock market for the next 4 to 6 years!

In its orthodox form, Elliott Wave never allows for such dogmatic forecasts. To the contrary, Elliott Wave typically allows for multiple, completely contradictory scenarios. If you have simultaneously bullish and bearish counts, it is of little value for trading.

The same way calculus elevated mathematics beyond algebra and trigonometry, the logical, self-defining limits and self-confirming aspects of NEoWave raise the field of wave analysis (and technical analysis in general) above the realm of opinion and hearsay and into the realm of science and fact.

With its step-by-step, practical applications, Glenn Neely's NEoWave has transformed - revolutionized - Elliott Wave. What began as R.N. Elliott's intriguing theory is now a more comprehensive and accurate market analysis and forecasting system.

Read more on Glenn Neely