Written by Glenn Neely

Author of Mastering Elliott Wave, Financial Forecaster & Trading Advisor

Founder of NEoWave Inc.

Are We Headed for a 1929-Style Stock Market Crash?

How can we answer this question? Let’s see what Wave Theory says.

Wait a minute. It turns out that not all Wave forecasters use the same process to conduct their analysis. Even when inputting the same data, some Wave analysts will produce Bearish scenarios, and some will produce Bullish scenarios. What’s the story?

For decades, two different philosophies have dominated the Wave forecasting landscape:

- Traditional (orthodox) Elliott Wave forecasters closely adhere to the original, rudimentary rules set forth by R.N. Elliott when he published “The Wave Principle” in 1938

- More sophisticated, in-the-know forecasters apply the rules and concepts of NEoWave, an advanced form of Elliott Wave. These rules and concepts add logic, objectivity, and reliability to the Wave forecasting process. This elevates NEoWave to a more scientific level, resulting in a higher degree of accuracy.

So, we have two different approaches to Wave Theory. How do they answer our question: Is the U.S. heading toward a 1929-style stock market crash? Let’s compare the orthodox Elliott Wave prediction with my NEoWave forecast. Let’s start with orthodox Elliott Wave.

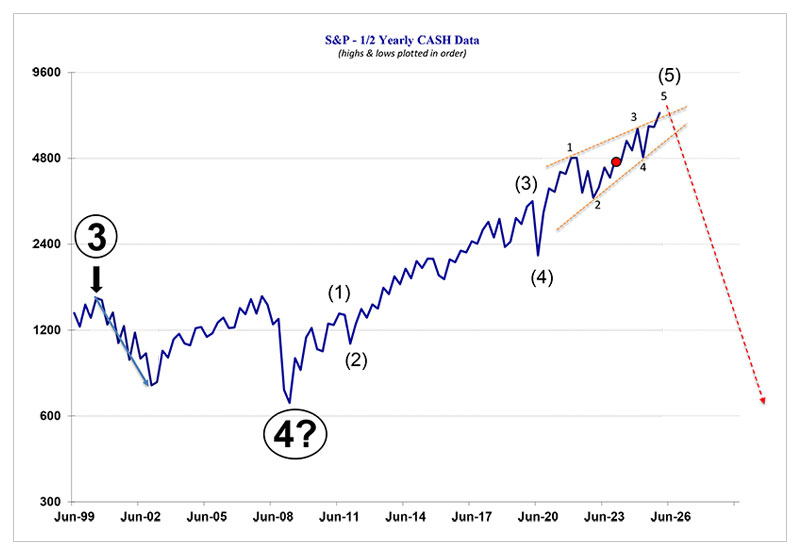

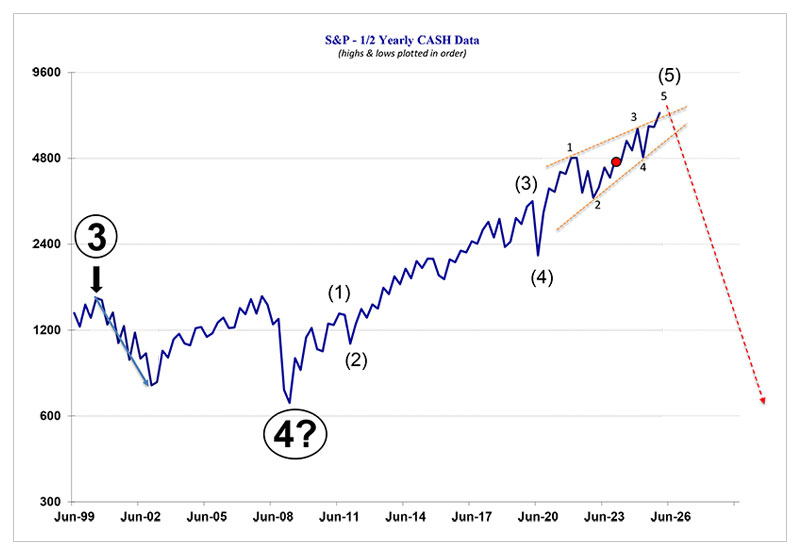

Orthodox Elliott Wave’s forecast: Doom-and-gloom BEARISH

For decades, the traditional Elliott Wave crowd has repeatedly predicted that the worst stock market crash in world history is just around the corner and that the U.S. is on the verge of a market meltdown. Chart 1 shows my best guess of what many are probably saying, thinking, and predicting (see the red-dashed line plunging downward in the chart).

So, to answer the question posed above, most orthodox Elliott Wave analysts would say YES – the U.S. is on the verge of a 1929-style stock market crash over the next few years!

CHART 1: Orthodox Elliott Wave's BEARISH Forecast

The traditional (orthodox) Elliott Wave crowd has been forecasting a doom-and-gloom Bearish U.S. stock market for years. Notice the red-dashed line plunging downward!

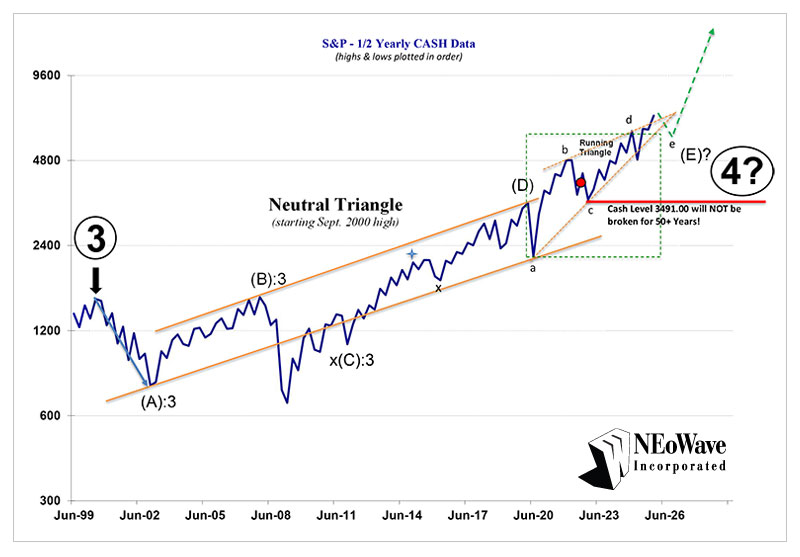

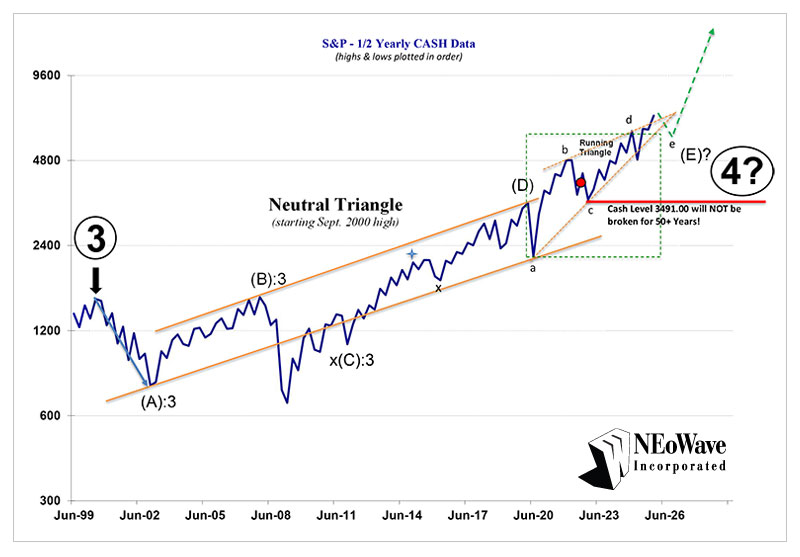

CHART 2: NEoWave's Super BULLISH Forecast

Ever since publishing my “Dow 100k” 72-year forecast in 1988, my NEoWave forecasts have consistently been super Bullish. Notice the green-dashed line soaring upward! I believe the U.S. stock market will enjoy an exciting and profitable Bull market advance into the year 2060.

NEoWave’s forecast: Super BULLISH

On the opposite end of the spectrum, NEoWave tells me the U.S. stock market will reach a point in the next 1-2 years where it will explode upward. My NEoWave forecast calls for a massive Bull market to begin late this decade that will produce one of the largest and fastest stock market advances in world history. As you can see in my chart, the NEoWave count shows a sizable sell-off into early 2026, followed by months of consolidation and negative news. Afterward, in 2027 or 2028, the largest, fastest Bull market in history should begin and last for 1-2 decades or more!

So, the NEoWave answer to our question is: NO, the U.S. will not experience a 1929-style market crash. We will enjoy an exciting and profitable Bull market advance into the year 2060.

NEoWave has called for a super Bullish market since 1988!

If you’re familiar with NEoWave, you may be aware that I published an article in the Foundation for the Study of Cycles magazine in 1988, which featured my 72-year forecast for the Dow Jones Industrial Average. In the article, I predicted the Dow would reach (or exceed) 100,000 by the year 2060. This forecast is now known as “Dow 100k.”

I posited that the U.S. stock market would continually and exponentially escalate for many decades to come. Currently, the Dow is about halfway through the longest vertical price advance drawn on the Wave chart that I included with that article. The current market highs prove that this long-term forecast is still on track. Now, after 37 years, it appears this 72-year Dow Jones market forecast may be the most accurate long-term forecast ever published!

As mentioned, I published my long-term forecast for the Dow Jones in 1988. Just a few years later, in 1995, I presented that forecast in a financial workshop. I remember showing the chart and discussing the massive Bull market that I projected, specifically pointing out that the Dow would get to 30,000 and then 40,000 and beyond. The audience gasped in disbelief. For perspective, the Dow had not yet reached 5,000 at the time!

“Wave Forecasting Showdown of the Century”

It’s interesting to note that orthodox Elliott Wave analysts have been proclaiming “end-of-the-world” Bear markets for virtually the last thirty years. My long-term, super Bullish outlook is a huge differentiator between NEoWave and the orthodox crowd.

This is a clash of two Wave philosophies that will be put to the test in the next 2-3 years! I firmly believe the orthodox Elliott Wave camp’s long-term, gloom-and-doom Bearish outlook will be proven wrong, and NEoWave's long-term, super-Bullish outlook will be proven right. I’ve dubbed this clash the “Wave Forecasting Showdown of the Century.”

Who will be right? Watch for more articles, videos, and news from NEoWave as this ultimate battle of the Bull vs. Bear unfolds!

Sincerely,

Glenn Neely

NEoWave, Inc.

Read Glenn Neely’s 1988 article presenting his “Dow 100k” forecast

CLICK HERE to read the full, original article Glenn Neely wrote in 1988, titled “The Future Course of the U.S. Stock Market: An Elliott Wave Viewpoint,” which steps through his 72-year stock market forecast. When you read the article, you can track the Dow's progress from 1988 to the present day, along with Glenn Neely’s “Dow 100k” forecast all the way to 2060.

(This article was initially published in the Foundation for the Study of Cycles magazine in its September/October 1988 “Elliott Wave” issue.)