Free Resources / NEELY RIVER Explained / The Forecasting Paradigm vs. The Trading Paradigm

The Forecasting Paradigm vs. The Trading Paradigm

by Glenn Neely, founder of NEoWave and Neely River Trading technology

Will you become a better trader by predicting what a market will do OR objectively managing the position decided on?

Why is the belief in forecasting – what I call the forecasting paradigm – detrimental to your bottom line and your trading success?

Simply put, forecasting is the reason most people don't do well trading. They spend most of their time trying to predict what a market will do.

Instead, they should objectively managing the positions they've decided to take – what I call the trading paradigm.

The forecasting paradigm

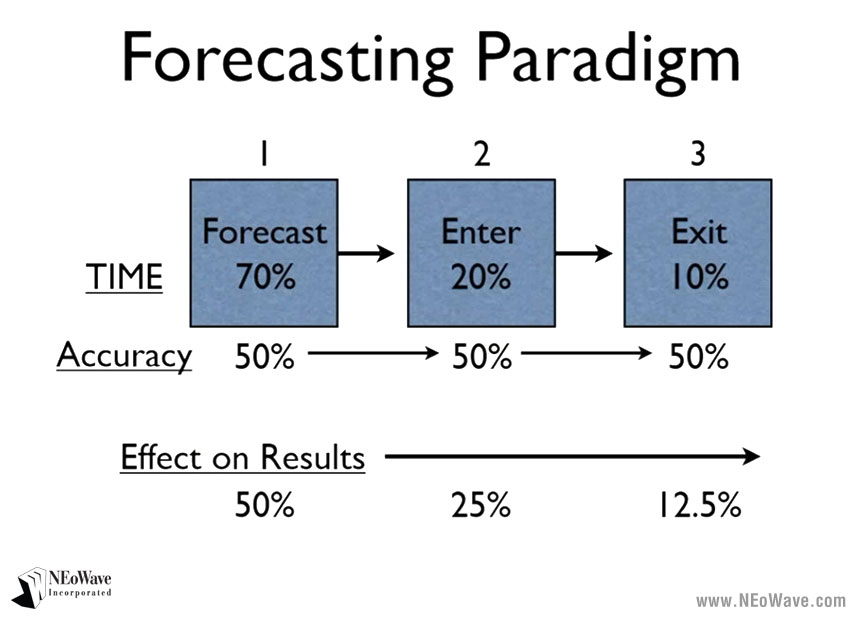

People who base their trading strategies on market forecasts will spend a tremendous amount of time trying to predict a market. They might spend as much as 70% or more of their "trading" time looking at various markets, trying to find a market worth investing in, and then trying to predict what that market will do. Perhaps 50% of the average person's forecasts might turn out to be right. It's probably less than that, but let's be generous here and assume your forecasts turn out to be correct half of the time.

Once you have predicted whether a market will go up or down, then you have to decide where you're going to enter. Let's say you think a market is going to drop down to $100 and then go up to $200. So you place an order to buy at $100, and it drops down to $101 and then rallies to $200. Well, your prediction was right, but your entry didn't happen, so you didn't make any money. Or perhaps you get in at $100, you place a stop at $90, and it drops to $89. But then it soars up to $200. Your stop was too close, and you didn't stay in the market before the rally happened.

Timing your entry can be challenging. Let's assume you're 50% right about where you should enter, whether you actually get in at that point, and whether your stop is actually hit or not before the market goes in the direction you think it's going to go. So we'll give this a 50% chance of likelihood that you get in successfully, and you survive without being stopped out.

Then there's the final part of the equation – getting out. Most people fail miserably here. The 2 most common scenarios are:

- When people get in and start making money, they tend to get out too quickly.

- If they start losing money, they tend to hang on too long, hoping and praying that things will get better.

Poor exit strategies are often based on what you believe the market will do.

Let's say you enter a market at $100 and – based on your forecast – you think it will go up to $200, so that's where you place your exit order. But it only gets to $199 and then drops back down to $100. You missed your chance to get out at a profit, so you lost all those potential gains. Or maybe the market goes to $300 but – based on your forecast – you got out at $200. You missed out on a lot of market action and profit.

If we assume a person's exit strategy is correct perhaps 50% of the time, then we can start to do the math on this forecasting paradigm process. Here is the 3-step process:

- First, you have to predict what's going to happen. You have to decide if the direction is up or down. There's a 50% chance you'll be right about the direction.

- Second, you need to decide where to get in. There's a 50% chance you actually get in, or you get a good price that doesn't put you at too much risk.

- Third, there's a 50% chance you will get out at the right price.

Let's do the math: 50% of 50% of 50% gets you down to 12.5%. Using this process to trade means you will only be right through the entire process about 12.5% of the time. Frankly, I believe this is generous, because there's a good chance most people won't be right 50% of the time at each step in the process.

This is why trading is so difficult for those who approach markets from a forecasting perspective.

Basing your trading decisions on your beliefs makes the process very complicated. It requires incredible precision and accuracy throughout multiple steps, just to be right 12.5% of the time. If you want to be successful trading, you have to start eliminating some of those steps, so you can get closer to a 50/50 chance of being right and being successful.

The trading paradigm

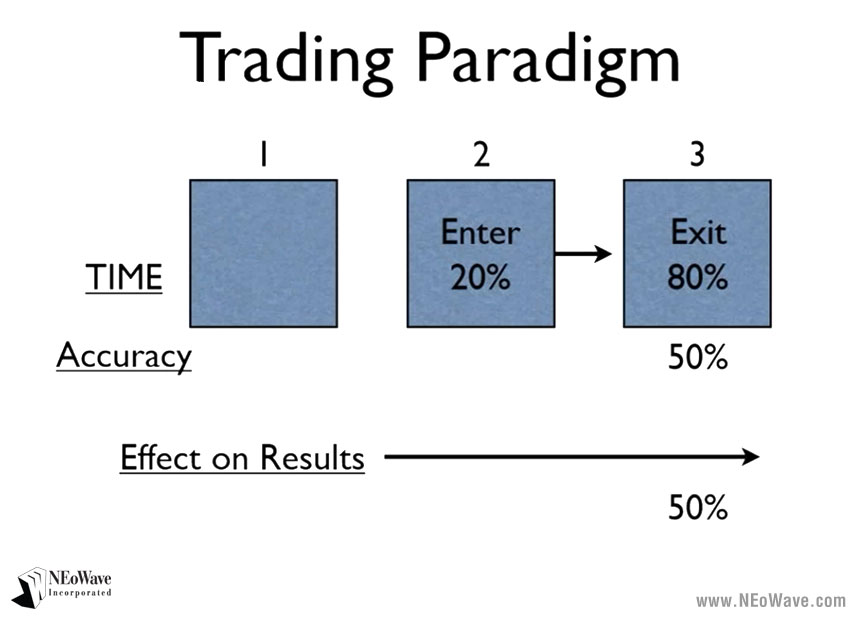

So let's get out of the forecasting paradigm and approach markets from what I call the trading paradigm. Here, you're not trying to predict what's going to happen, and you're not personally deciding when and where to get in. Instead, the only decision you have to make is when to get out. This moves your chance of success up to about 50%.

Yes, you have a 50% chance of being right and a 50% chance of being wrong, but you now have a logical process to:

- cut your losses very quickly and

- let your profits run without getting out too soon.

This means 50% of your trades may be losses – but they can be small losses. And the winning 50% of your trades will make money – and they can be very large wins.

Over time, this is what really separates a successful trading campaign from a losing campaign. If you want to get rid of all those extra variables, you need a simpler, more streamlined process that does not involve a lot of guesswork. You need to let the market dictate (for the most part) when to get in, how to get in, and how to exit, so you can then manage your risks.

In short, you need to manage your entries and exits based on profit and loss, not based on what you believe is going to happen.

Operating in the trading paradigm – instead of the forecasting paradigm – completely turns the trading process upside down.

It's important to realize that making this shift is a big adjustment. It took me 25 years to realize something was missing in my trading approach, even though I had great periods of accurate predictions and I made good money. I also had other periods where my forecasts were completely wrong and I lost money, because Wave structure was unclear or I thought I knew what would happen but it turned out that I didn't.

At that time, I didn't have a process to manage positions in a way that was independent of what I believed was going to happen. Remember, it's your belief system that gets in the way of doing what's right – and getting real trading results.

Have you experienced this trading scenario?

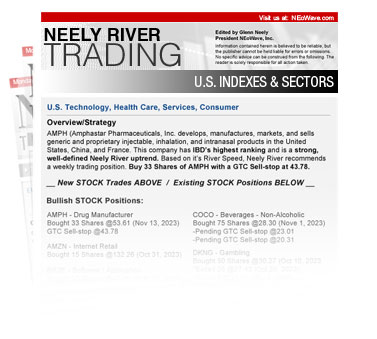

In my Professional Trading Course, I teach Neely River Trading technology to experienced traders.

I always ask my students if they have experienced the following situation:

You got into a trade based on a forecast, and that forecast indicated the market would go up, but it started going down right away, and you stayed in because your forecast kept telling you the market would go up.

But it kept going down, and you kept losing money. You had a disaster on your hands, because your forecast was completely different from reality, and you lost money.

I would then ask: "How many of you have experienced something like this?"

Every time I ask this question, every person raises their hand – and that includes me! We've all been there, right?

By using the trading paradigm, you can get away from a process that is based on belief. Instead, you need a process that enables you to objectively accept if you're right or wrong and quickly make a decision. When trading markets, there is no guarantee. There will be losing positions, but you can minimize your losses. You cannot risk losing so much on one trade that it wipes out your gains on other positions.

That's why it's important to follow a logical, rational, mathematically designed process that enables you to manage profits and losses, so your losing positions never overwhelm your profitable positions.

This enables you to achieve your ONE goal when trading: Make money.