NEoWave News

October 12, 2011

News: NEOWAVE TRADING PERFORMANCE ACHIEVES 400% RETURN FOR CLIENTS IN LAST 5 YEARS

NEoWave Releases Detailed, Multi-Year Performance Data

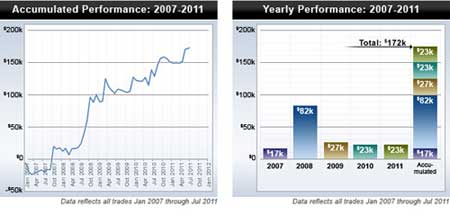

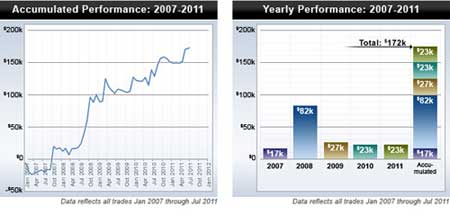

October 12, 2011 - NEoWave has published detailed, actual performance data achieved by NEoWave Trading Services, revealing a record that has consistently beat the market since 2007. According to Glenn Neely, Wave theory expert and founder of NEoWave Institute, the net of all Daily and Weekly NEoWave Trading service recommendations from January 2007 through July 2011 was more than $172,000.

"While many stock market advisors cannot, or will not, post their track record, we are happy to provide precise, actual trading performance data to the general public. Following a massive effort by our programming team, a detailed Excel spreadsheet is now available on the NEoWave website," Glenn Neely says. "A NEoWave customer - following all NEoWave Trading Service recommendations the past 4 years - would have experienced a 400% return on starting capital (assuming 1 Futures contract per recommendation and a starting balance of $40,000)."

The 7 companion charts on the NEoWave website show accumulated, yearly and individual market performance for every Daily and Weekly NEoWave trade recommendation since January 2007 for the S&P, Gold, Notes, and Euro currency.

The NEoWave website also lists recognitions by Timer Digest, which ranks Mr. Neely's performance relative to other leading technical analysts. In 2011, Glenn Neely has been recognized 17 times as a Top 5 S&P Timer and Top 5 Bond Timer.

Click to view the Timer Digest rankings.

Glenn Neely, internationally regarded as the premier

Elliott Wave analyst, founded the Elliott Wave Institute in 1983. In 1990, Neely published his advanced Wave analysis process in his now-classic book, Mastering Elliott Wave. In 2000, Neely changed the name of his research and advisory firm to NEoWave Institute to differentiate his scientific Wave analysis technology from orthodox, subjective Elliott Wave analysis, which is frequently nebulous, inaccurate, and constantly fluid.

What is Elliott Wave? In the early 1930s, Ralph Nelson Elliott presented his theory of market behavior, which quantifies each stage of an economic cycle into specific patterns of mass psychology. Glenn Neely has devoted more than 25 years to mastering and advancing the concepts of Wave theory. Neely refined Elliott Wave theory to make it objective, practical, and consistently accurate, producing his now-famous NEoWave technology. This precise, step-by-step assessment of market structure leads to low-risk, high-profit investing and trading. Orthodox Elliott Wave, devoid of such technology and rules, typically leaves the analyst with ambiguous interpretations, seriously flawed results, and dual-directional forecasts.

Today, decades after R.N. Elliott penned his original theory, countless investors and traders trust Neely's revolutionary, step-by-step NEoWave approach to market analysis. Devotees of NEoWave Institute and Glenn Neely are reaping the rewards of low-risk, high-profit investing. Learn more about Glenn Neely and NEoWave Institute at

https://www.NEoWave.com.

Learn about NEoWave's Forecasting Service.

Learn about NEoWave's Trading Service