From the desk of NEoWave and NRT technology founder, Glenn Neely

JANUARY 23, 2022 (10:30 am Pacific Time)

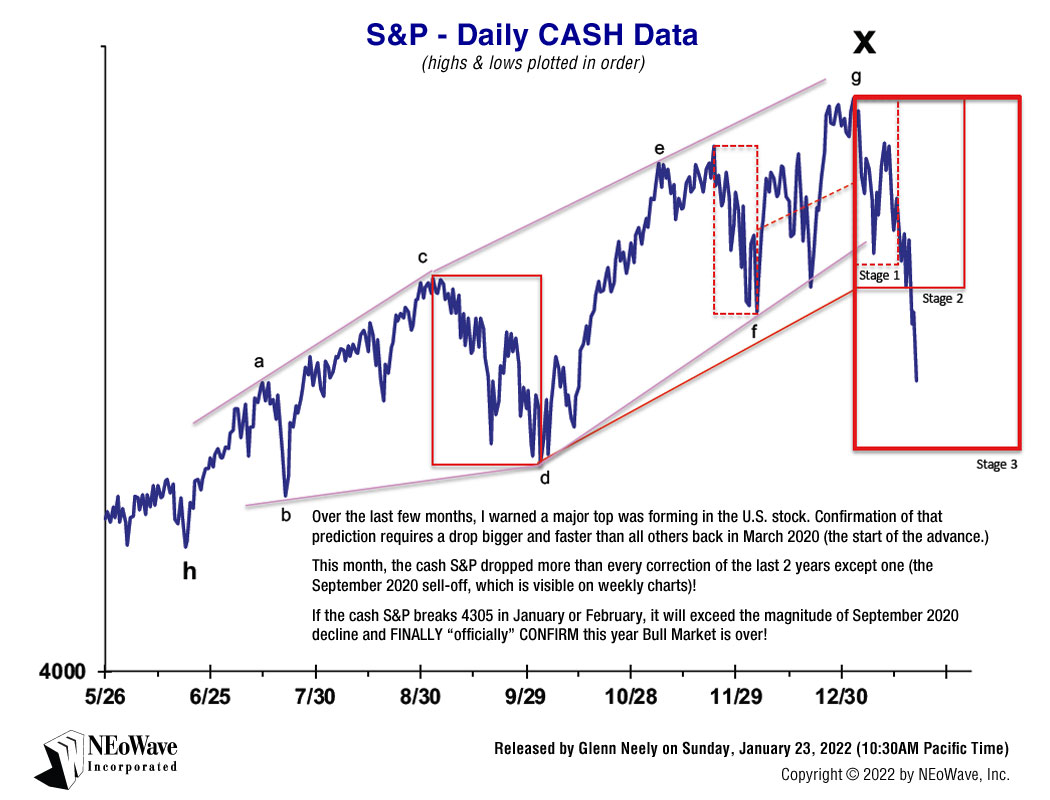

STAGE 1 & STAGE 2 CONFIRMATION ACHIEVED

Under NEoWave theory, the only way you can be confident a pattern has concluded (and that your analysis is accurate) is after "confirmation" has occurred. Confirmation is when post-pattern price action moves further and faster than the largest counter-trend wave of the prior pattern. This process always occurs in stages, starting from the smallest timeframe to the largest. If a pattern ends daily structure, confirmation can begin on intra-day charts and work up to daily. If the pattern forming is ending 6-monthly structure, confirmation will "roll up" from daily to weekly to monthly and finally to 6-monthly charts over days, weeks, and months.

In September, I warned that a major stock market top was forming in the S&P. Those public announcements occurred after daily and weekly confirmation; unfortunately, the S&P never dropped far enough and fast enough to confirm monthly structure. As a result, Stage 1 & 2 confirmation never rolled into Stage 3, thereby nullifying the "emergency" that typically follows. Consequently, the S&P was able to recover and make new, all-time highs in November and December. Whenever full confirmation is not achieved, the process "resets."

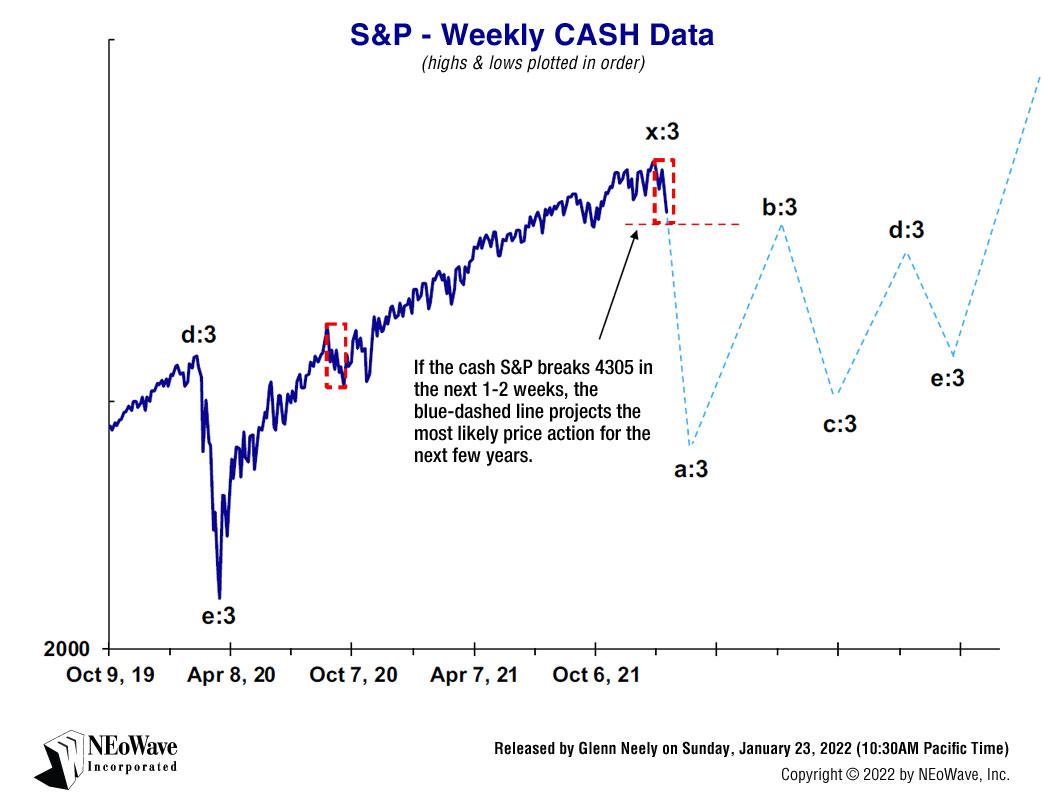

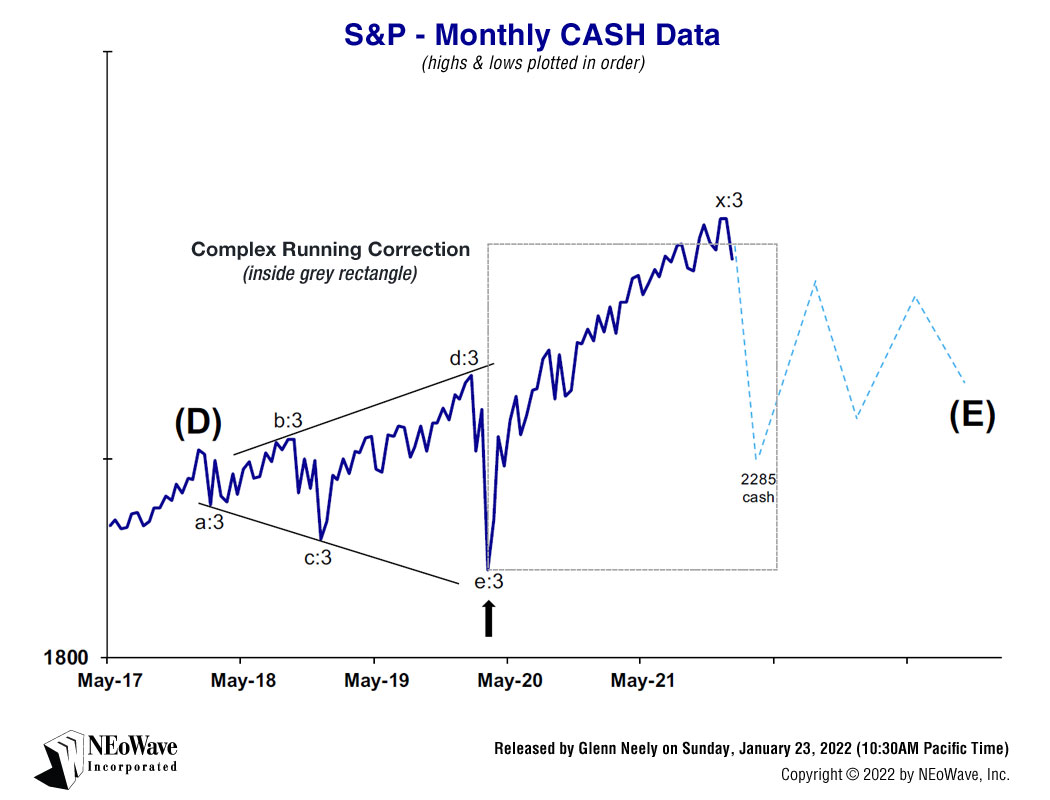

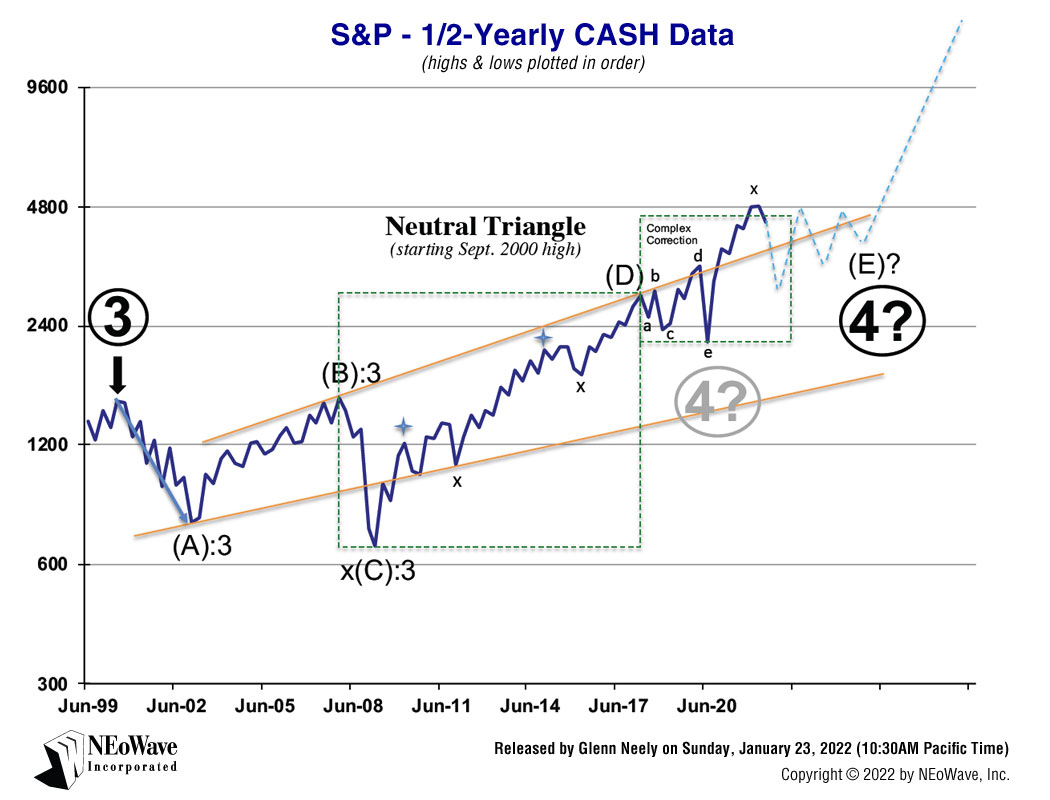

For the first time since September, the S&P has dropped fast enough to, once again, give us Stage 1 confirmation (see the daily chart below) and Stage 2 confirmation (see the weekly chart below). As each larger degree confirmation is acheived, the odds increase that confirmation will occur on the highest timeframe. For example, when the S&P recently dropped enough to achieve Stage 1 confirmation (see the dashed red rectangle), the odds were about 60% the "bull market" off the March 2020 low was over. When Stage 2 confirmation occurred last week (see the smaller solid red box on the daily chart), the odds increased to about 80%. IF the S&P is able to achieve Stage 3 confirmation this week or next week (see the larger red box on the daily chart), the odds will increase to 90%+ that the bull market is over and that a 3-5 year bear market correction is underway (see blue-dashed forecast line on monthly and 6-monthly charts).

Stage 3 confirmation requires the cash S&P break 4305 by or before early February (the sooner the better). If that occurs, we can be confident the bull market is over and that a very large, volatile bear market consolidation has begun. If the cash S&P DOES NOT break 4305 in the next few weeks, then once again the confirmation process will "reset" and the S&P is back in an environment where it's possible all-time new highs will be made later this year.

Sincerely,

Glenn Neely

Founder of NEoWave and Neely River Trading technology

NEoWave, Inc.

www.NEoWave.com

CHART 1 - S&P DAILY

CHART 2 - S&P WEEKLY

CHART 3 - S&P MONTHLY

CHART 4 - S&P 6 MONTH