Written by Glenn Neely

Author of Mastering Elliott Wave, Financial Forecaster & Trading Advisor

and Creator of Neely River Trading Technology

Founder of NEoWave Inc.

Now, you can time your exits with confidence!

When you apply my profit protection strategy, you can objectively exit positions and let profits run

Many traders (even highly experienced traders) struggle with these questions:

- “How do I know where to place stops?”

- “When should I exit a position?”

- “How can I objectively control losses on losing trades?”

- “How do I know when to protect a position, so I can let profits run?”

Do you struggle with these questions as well? If so, keep reading. I think you'll be interested in learning how to apply my profit protection strategy. I've always believed that profit protection and capital preservation are critical concepts that every trader should learn, so you can protect your bottom line. Essentially, it comes down to actively – and unemotionally – managing both losses and profits throughout the trading process.

In fact, I consider profit protection to be the most important part of trading and investing, because you need an ongoing, objective way to continuously watch your bottom line – and know when to exit. Otherwise, when the markets start going against you, your whole account can blow up fairly quickly.

Unfortunately, most people tend to hang onto losing positions, hoping the market will turn around. They use their forecasts to rationalize bad trades, saying things like, “Well, my forecast says it’s supposed to go up; so, I’m just going to keep waiting until it does.” In the meantime, the market keeps going down. Once you make an investment, good trading becomes a process of observing and reacting to reality – not relying on forecasts, hopes, or expectations. You must take action based on actual, real-world performance.

I encourage NEoWave customers to focus on trading performance – instead of focusing on physical stops.

A lot of traders spend a great deal of time identifying precise stop levels. Instead, the focus should be on bottom-line results – taking action based on the positive or negative performance of a position, NOT a specific stop level. Often, markets “run stops” only to reverse before the day is over. So, definitive action on exiting losses should be conducted in the last hour of the day. If the unacceptable loss is still present, then exit into the close. Once in a position, make your decisions based on objective performance data.

For example, let’s say you’re buying stock positions, and you buy 100 shares for $100. The market goes down 10% – that’s when you start getting concerned about the position, and you may start lightening up. By the time it goes down 15%, it’s generally time to get out. Perhaps you didn’t enter well or maybe something happened to the company, which affected its stock. But the downward trend is potentially the beginning of a much worse situation. If you hang onto it all the way until it drops to zero, then you’re going to lose all your money. So, you need to have a clear point where you give up – objectively and unemotionally.

This is where I rely on my profit protection strategy to guide my decision-making when I’m trading physical stock. Generally, at the end of the day (mid-day if the markets are active), I’ll look at how things are going. If my position starts to lose about 15% of its value, I simply get rid of it. I don’t try to analyze or rationalize the situation. I accept it was a bad decision and move on.

I also encourage traders to follow the three-to-one win-loss ratio.

My profit protection strategy aligns with the advice of most trading professionals: Try to make at least three times what you’re risking when you’re entering an investment. To accomplish that, when you’re losing, you have to exit losing positions when they are losing one-third of what you expect to make on your profitable positions.

In other words, your goal is to try to make three-to-one (or more) on any trade you’re taking. So, if you’re going to get out at 15% for a stop loss, that means you’re hoping to make about 45% – three times the loss level.

If you give a position enough time and your entry was good, eventually it might get to that 45% profit point. And then you can start taking some of your position off the table. If you want to stagger this, you could have 10% as one breakpoint, 12.5%, and 15%. And on the profit side you could take some profit at 30%, 37.5%, and 45%.

And here is a critical point – I don’t completely exit any position until conditions change on a long-term basis. I use monthly charts to determine trend. So, if I’m buying a stock, the monthly chart is the controlling timeframe. If the stock goes up 30%, I will exit some or protect the position with Short Calls. If it goes up 45%, I will take some more off the table. But I don’t completely exit; I leave the rest in case the market goes up 100%, 200%, or more.

You should never have a target to exit everything unless conditions start to change – perhaps you see monthly trend deterioration. That’s when you should accept it’s time to get out. As long as the monthly trend remains strong and you’re making money you should hang on, because it could end up getting a lot better than you ever expected. You don’t want to miss those really big moves that can make up for 5 or 10 small losing trades.

Clearly, one reason for taking the small losses – around 15% for stocks and 30% for options – is you want to have money in your account to invest again. It takes just one good trade to make up for two or three losing trades. That means you don’t have to be constantly right. One of the biggest problems with forecasting is that it requires you to be right most of the time, which isn’t possible.

If you can only be right about half the time – and you’re following a three-to-one win-loss ratio – then you’ll end up doing well. But you have to be very disciplined about taking those losses when they occur.

When you follow my profit protection strategy, your focus is strictly on this question: Is this the right time to get out or not?

At the end of each day around the close, you simply look at the data and assess:

- How much is my position losing?

- Has it reached the “get out” point or at least “partial liquidation” point?

- If not, then you hang on for another day. This will force you to stay in your winning positions longer than your losing positions, allowing the winners to make three times or more than your losing positions.

This strategy fits right in with that famous saying: Cut your losses quickly, and let your profits run. The only way you can do that is to actually have a percentage-based liquidation strategy based on how much you’re losing and how much you’re making.

NEoWave customers often ask me: "How often should I check the market?"

If the market is in a strong trend and fairly active, you might want to check midday and then again toward the end of the day. If it’s pretty dead, then checking around the close is perfectly fine, just once a day.

Plus, there’s another factor you should consider. If your entire portfolio has a nice bottom-line profit – say you’re up 10% in open trade equity – you can be more flexible on how often you look at your account. But if your total return is negative, you’ll want to watch your account multiple times a day, because your goal is to make sure you don’t lose money. If you have a nice buffer, you don’t have to pay as much attention. If you don’t, you’ll want to cut losses even faster to make sure your portfolio doesn’t decrease in value too much.

Keep in mind that early in the morning and late in the afternoon, markets will often gap up or gap down following unexpected news events. A lot of wild gyrations can happen, but they usually don’t last. Typically, by the end of the day markets calm down. If you focus on the price toward the close and take action based on “near closing” values, you’ll avoid most of the whipsawing that takes place throughout the day.

When you apply the logical, objective profit protection strategy, you can more readily control losses as well as profits.

When you use my profit protection strategy, you can make logical, objective, unemotional decisions with a lot less stress! I was in the prediction camp for 30 years, trading futures and always worrying about where to move my stops. There was constant stress. Always having to worry about stops means you’re constantly trying to predict what the future holds. But you can never know for sure; you can only guess. Obviously, your guess will only be right about 50% of the time – if you’re lucky.

So, you want to base your decision-making strictly on things you know with 100% certainty. The performance of a position is NOT an opinion; it simply comes down to this question: Is my position making money or losing money? And then taking action accordingly.

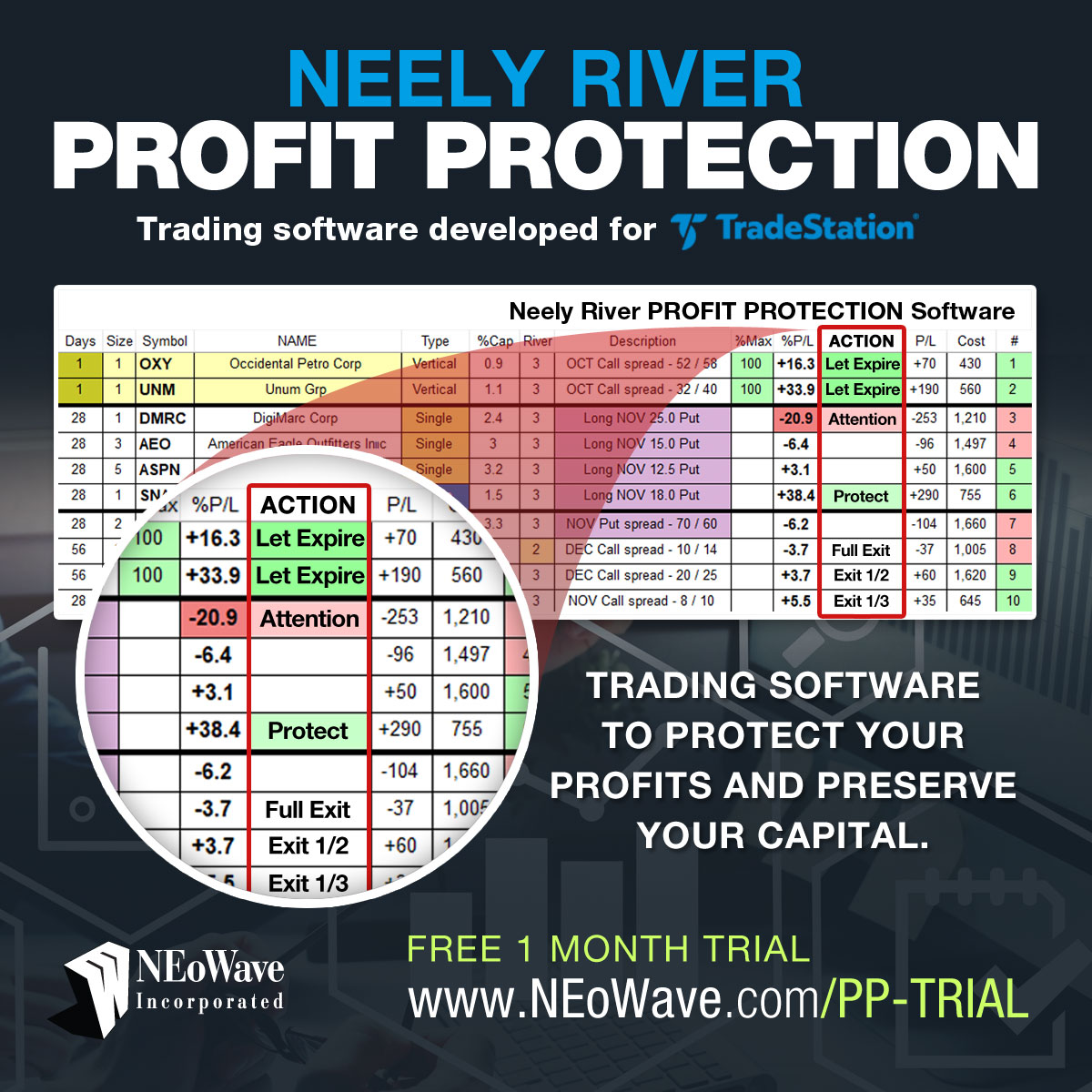

Introducing Neely River Profit Protection Software for TradeStation

My programmer and I have created Profit Protection Software that is easy to use – it is a daily part of the strategy employed in the NEoWave (Neely River) Trading Services. I’m happy to announce that we’re now making it available to the public.

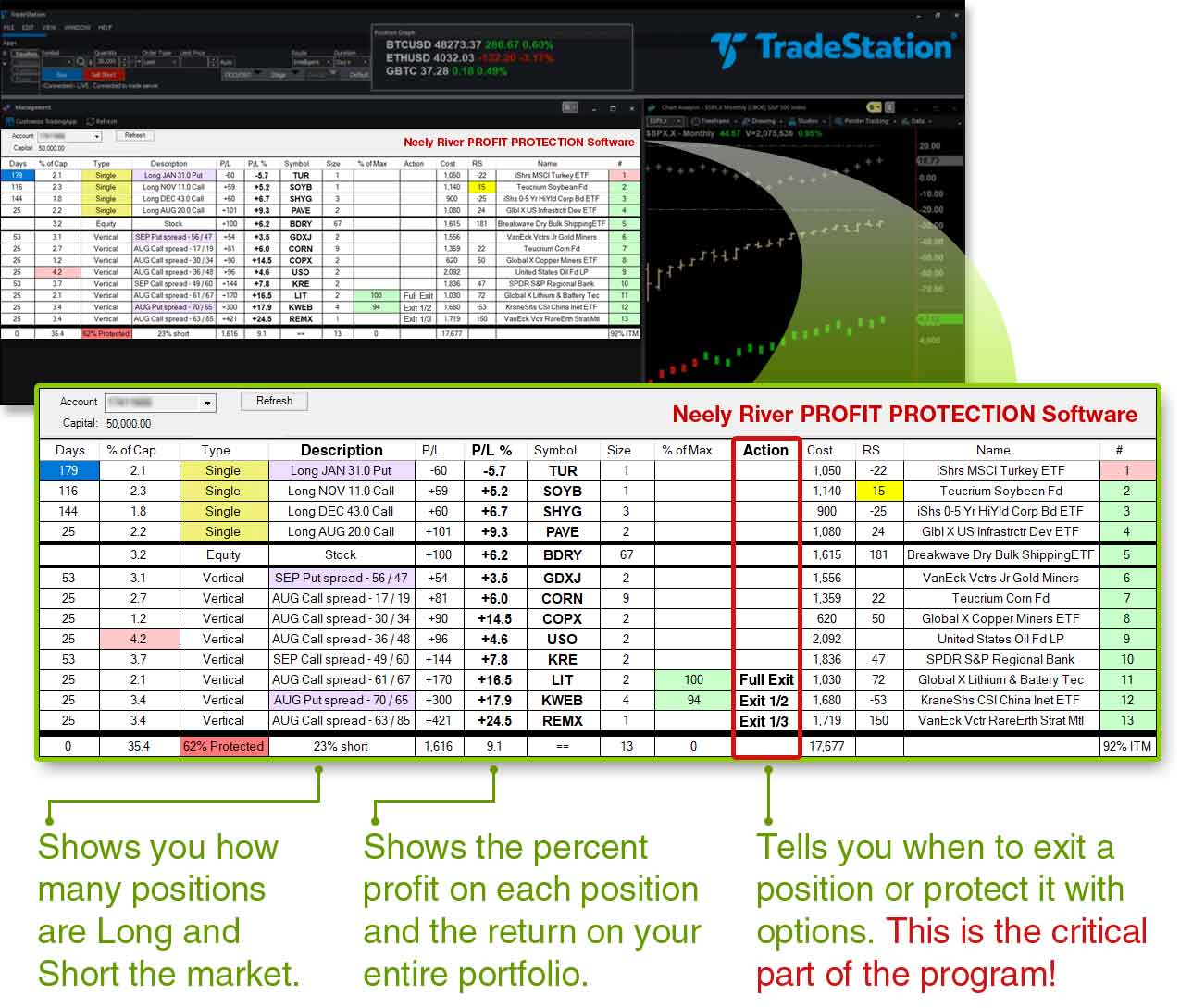

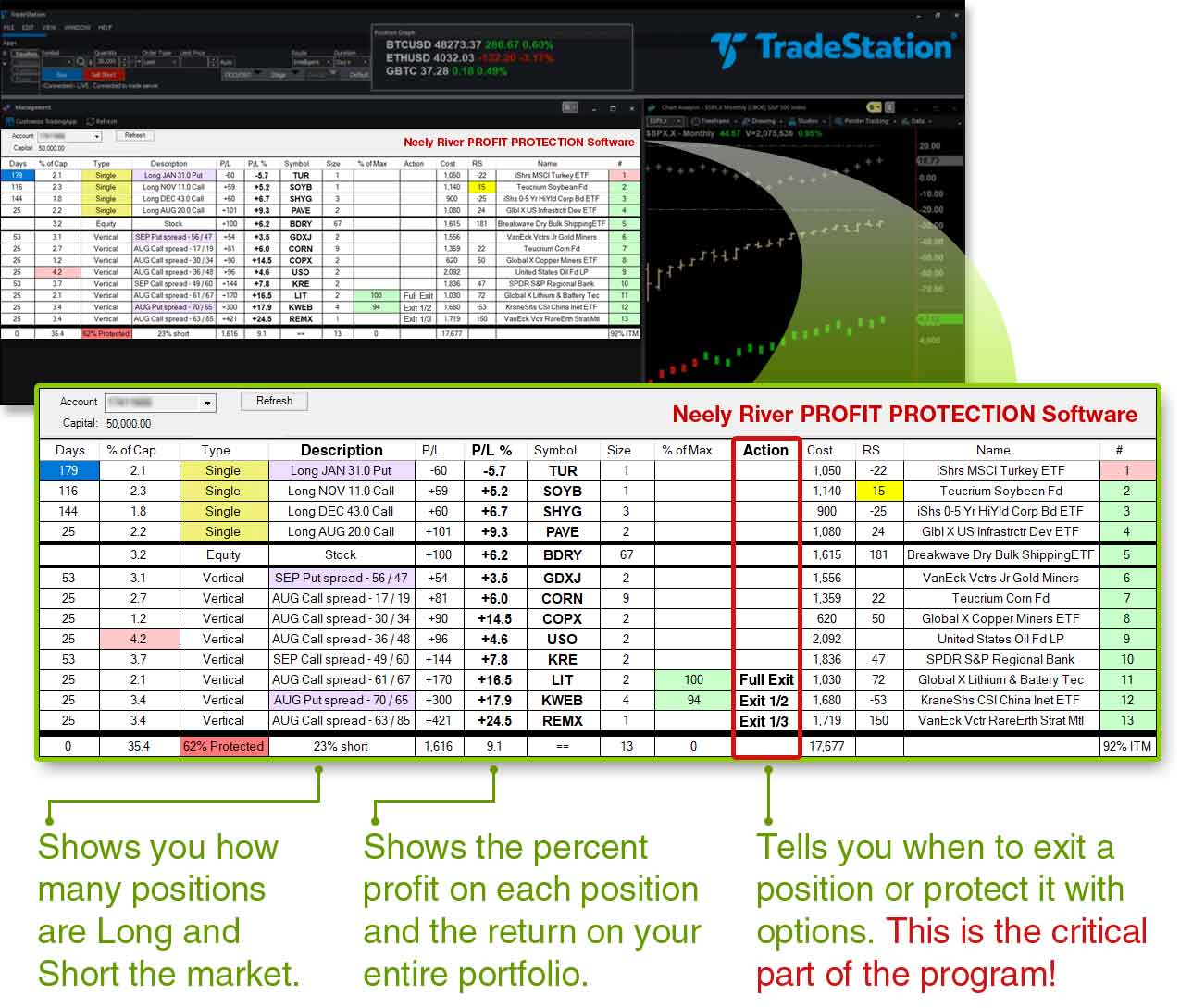

Once you log in to your Tradestation account, our Profit Protection Software organizes information on your positions, so you can quickly see the size of each position, a description, and whether it’s a single option, vertical spread, naked stock, or covered Call. It also calculates how many positions are short the market. Plus, it shows how much return on capital you’re making, the percent profit per position, and your total return on investment.

And here is the critical part: This program will actually tell you when you should exit a position (partially or fully) or if you should protect the position with Short Options.

This is a unique program – I don’t know of anything like it in the marketplace. It’s sophisticated, and it’s incredibly easy to use! You can quickly see how many positions are making or losing money, essentially a snapshot of how you’re doing – your own bottom line. This allows you to objectively manage dozens of positions in just a few minutes each day.

If you have a TradeStation account, you can sign up for a free 1-month trial of the Profit Protection Software.

Learn more and sign up for the FREE Trial at:

https://www.neowave.com/PP-TRIAL

If you don't have a TradeStation account, you can open a TradeStation account today.

Take advantage of a SPECIAL OFFER from TradeStation & NEoWave, Inc. Enjoy a Trade Commission-Free + Get up to $5,000 with a qualifying deposit. To get this SPECIAL OFFER visit:

https://www.tradestation.com/promo/neowave

Neely River Profit Protection Software:

Get a FREE 1-Month Trial

Neely River Profit Protection Software

Trial requires TradeStation account

START FREE TRIAL